Algorithmic Trading Driven by

Where Intelligence Meets Compliance in Every Market Move. Empowering investors with autonomous yet auditable decision-making systems.

AI-Driven Algorithmic Wealth Model Creation — “From Execution to Intelligent Wealth Engineering”

Innovating India's AI-Driven Trading Future

At Metalokas, we merge deep financial expertise with cutting-edge technology to create autonomous trading solutions. Our Agentic AI engine delivers scalable execution strategies with SEBI-grade reliability.

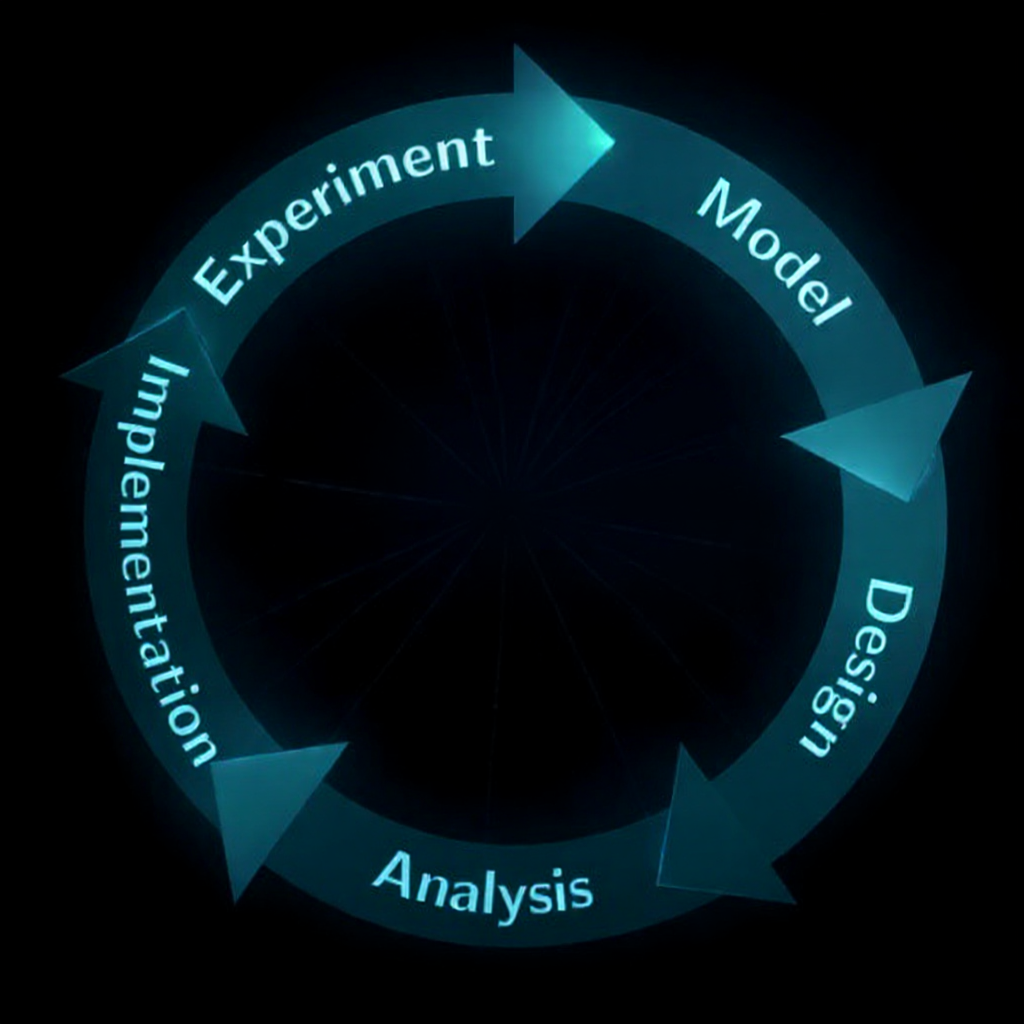

Our philosophy is rooted in rigorous quantitative research, robust risk management, and an unwavering commitment to client success. We don't just follow the market we model it, understand its nuances, and capitalize on opportunities 24/7.

Engineering

Our Service Offerings

Comprehensive algorithmic trading solutions designed to maximize returns while maintaining the highest standards of compliance and security.

AI-Driven Trading Systems

Custom-built systems using machine learning to adapt to markets and optimize strategies in real-time.

Predictive Analysis

Advanced analytics and pattern recognition to predict market trends and generate actionable insights.

Strategy Automation

Fully automated workflows from signal to execution, reducing latency and human error.

Compliance Support

A comprehensive framework ensuring all trading activities meet Indian SEBI requirements.

The Power of Agentic AI

Autonomous, Auditable, and Scalable Execution.

Autonomous Decision-Making

Our AI agents operate independently to analyze markets, identify opportunities, and execute trades based on pre-defined, rigorously tested strategies.

SEBI-Grade Reliability

Every action taken by our AI is fully auditable, providing a transparent and compliant trail that adheres to the highest regulatory standards.

Our Agent Architecture

| Agent Name | Function |

|---|---|

| Signal Perception Agent | Pulls data from external sources and APIs. |

| Context Agent | Evaluates market conditions and overall context. |

| Risk Agent | Enforces safety protocols and risk management rules. |

| Decision Agent | Chooses trade actions based on all inputs. |

| Execution Agent | Places orders via broker APIs for execution. |

| Logging Agent | Stores logs, learns from outcomes, and reports performance. |

Demonstrated Performance

Consistent growth and rigorous risk management are the cornerstones of our performance. (Note: Data is illustrative and for demonstration purposes only).

Get In Touch

Ready to revolutionize your trading strategy? We'd love to hear from you.

Contact Information

Plot No 1/C, sy No 83/1, Raidurgam Panmaktha Hyderabad Knowledge City, Hi-tech city, Hyderabad, Telangana 500081